The NEER and REER page has been updated, as has the Google Docs version.

Summary

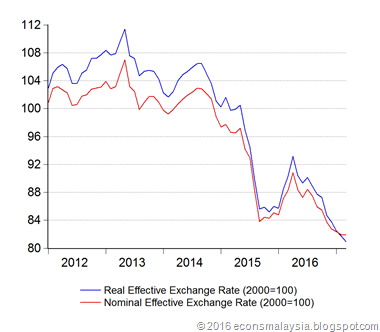

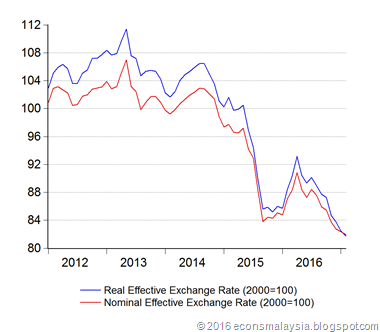

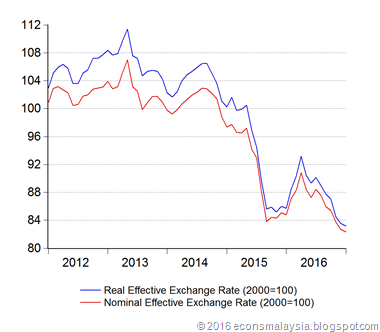

The Ringgit has continued to strengthen across October and November. The yoy growth numbers all turned positive in November with the exception of the Real ASEAN sub-index, while mom growth has been positive for three months running. Gains were broad based, though skewed a little more against the majors, and less so against regional counterparts. The Broad Nominal Index rose 0.36% in October and 1.26% in November, while the Broad Real Index rose 0.72% in October and 1.30% in November.

In November, the only drop recorded was against the KRW (-1.35%), which has been on a tear this year. The biggest gain recorded was against the AUD (Oct: 1.89%; Nov: 3.64%).

Changelog:

- Indexes have been updated to November 2017

- CPI deflators and forecasts have been updated for October/November 2017