What a difference a few months make. With increasing uncertainty over global growth and the threat of defaults in the Euro area, there’s been a general retreat from emerging market currencies to “safe-haven” currencies such as the Yen, the Swiss Franc and especially the USD.

No surprise then that the trade-weighted indexes have both dropped (index numbers; 2000=100):

Note that the MYR’s retreat actually began around April – which incidentally coincides with BNM’s intervention to hold the Ringgit back (or if you prefer, reserve accumulation exercise) at around the same time.

As far as trade competitiveness is concerned, the flight to safety has covered nearly all the emerging market currencies of Malaysia’s trade partners, with one big exception. Here’s the movements of the MYR relative to our 5 biggest trade partners (cumulative log difference since July 2005):

The MYR has lost ground against the USD, but even more so against the JPY and CNY. No surprise regarding the Yen, as it’s considered a safe haven currency. But the drop against the CNY, and relative stability against the SGD suggests that China is seeing this as an opportunity to push real appreciation of the CNY without a nominal appreciation against the USD.

You can see more evidence of the impact of capital flight in the ASEAN currencies (cumulative log difference since July 2005):

As you can see, the cross-rates have been stable over almost the whole of 2011, which means that the sell-down in favour of the USD has affected all of ASEAN, though a little less so for Singapore (see the chart above this one).

What this means –with the exception of China, don’t think that we’ve actually gained ground in terms of trade competitiveness from lower price of our products. Since the sell-down has been general, there’s actually been little change despite the MYR retreating against the USD.

For the rest (cumulative log difference since July 2005):

…the main points to take away here are that both India and Korea appear to be seen by investors as more at risk from the slowdown in global growth (MYR has appreciated against both), while the HKD has followed the CNY in strengthening. Bear in mind though that the HKD is still tied to a USD-based currency board, so you can’t read too much into that.

I’m waiting on the end of month data before commenting on BNM moves here, but news reports have already confirmed that BNM has been providing USD liquidity for the domestic banking system, which means there ought to be a drop in reserves. I don’t know how much yet, though I doubt that it will be on the scale of 2008, when reserves dropped over RM80 billion or over 20% in the last four months of the year.

Still, the numbers I’ve presented here are only up to the end of September, and the data up to last week is showing further depreciation in the Ringgit’s value against the USD, CNY and JPY of around the same magnitude as the whole of September.

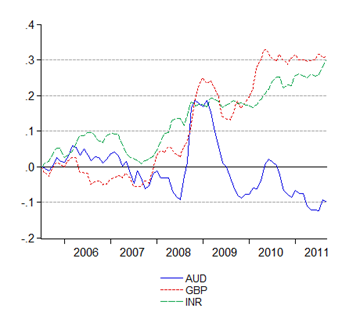

Going forward, at a guess I would say that at some point, even if uncertainty continues, downward pressure on emerging market currencies will drop away as those investors who want to leave have left. I still do have to caution though that India and Vietnam’s currencies look to me like having high medium term risks, as internal inflation in both countries has continually pushed the real effective exchange rate away from their nominal values (index values; 2000=100):

A sudden-stop capital flight scenario might crash both currencies a’la East Asia in 1997-98. The only thing holding these currencies up are capital controls. If you have investments in either of these countries, hedging might be a good idea.

No comments:

Post a Comment