December’s outsized trade numbers didn’t looked sustainable, as yesterday’s trade report proved:

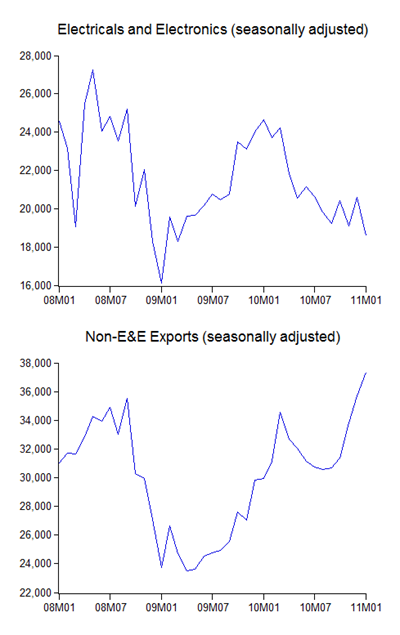

Most of the slowdown can be blamed on electronics and electrical exports (RM millions; seasonally adjusted):

…basically eating up the (seasonally adjusted) improvement in everything else. The result is a plunge in the share of E&E exports over total exports:

From over a 60% share at the beginning of 2000, E&E now comprises less than a third of total exports. Quite a come down.

This is partly a reflection of declining E&E output from slowing FDI, as well as the larger importance commodity exports have taken since 2007.

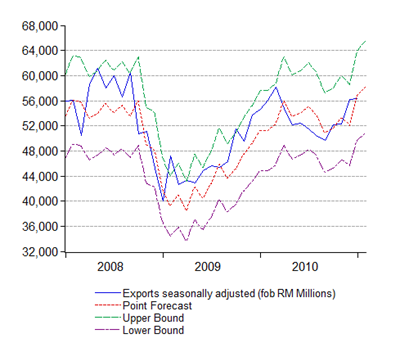

We’re likely to see a further slowdown in the unadjusted numbers in February, due to CNY and lower number of working days during that month (which explains the divergence in forecasts for the two models below):

Seasonally adjusted model

Point forecast:RM58,235m, Range forecast:RM65,555m-50,915m

Seasonal difference model

Point forecast:RM50,647m, Range forecast:RM57,844m-43,450m

Technical Notes:

January 2011 External Trade Report from MATRADE.

No comments:

Post a Comment