Over the last two weeks, rhetoric has been building up over currency “manipulation” among major trading nations. The biggest target is of course China, with the turtle-slow adjustment of the CNY-USD exchange rate, but their far from the only ones. The Bank of Japan intervened in the Yen market in a big way last month, and Brazil, South Korea and Indonesia have instituted capital controls to a greater or lesser degree. Nor is currency intervention limited to emerging or Asian markets, as Adam Kritzer talks about in this blog post:

Currency War: Who are the Winners and Losers?

It’s still too early too early to say how far the currency war will go. The G7/G20 has announced that it will address the issue at its next summit, though it probably won’t lead to much in the way of action. Ultimately, politicians can’t do much more than shake their fingers at countries that try to hold down their currencies....

…That brings me to my final point, which is that all currency intervention is futile in the long term, because most Central Banks have limited capacity to intervene. If they print too much money to hold down their currencies, they risk stoking inflation…For Central Banks to successfully manipulate their currencies on the spot market, they must fight against the Trillions of Dollars in daily forex turnover. Eventually, every Central Bank must reckon with this truism.

Adam’s also one of the very few commentators that have realised that the quantitative easing conducted by the Federal Reserve and the Bank of England (and incidentally, by the BOJ over the last twenty years), is also a form of currency manipulation – increasing the supply of currency puts downward pressure on the exchange rate. That makes all the pious criticism from the IMF and from the US Congress more than a little ironic.

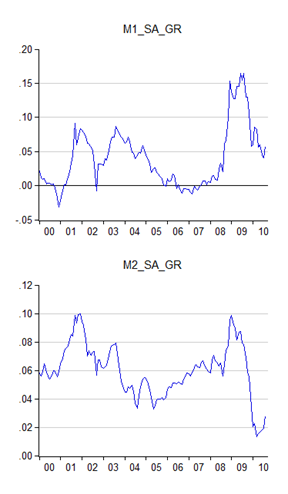

I think Adam’s wrong on one score though. The flood of money coming into emerging markets isn’t a result of the Fed’s and the BOE’s QE programs – it’s a result of the concurrent zero-interest rate regimes these central banks have had to pursue, as Joseph Stiglitz points out. That may sound like splitting hairs (they’re almost, but not quite, tantamount to the same thing), but getting the transmission mechanism right means you’re half way to finding a way to do something substantive about it. The Fed’s QE program has flooded the US interbank market with USD, but almost none of it has leaked out into the broader economy, or into other investors’ hands (log annual changes in seasonally adjusted M1 and M2):

You can clearly see the Fed’s monetary intervention in late 2008 (first chart above), which has moderated since. But M2 growth indicates that the banking system hasn’t responded by creating more money – quite the opposite, money supply growth has instead crashed, and is only just beginning to recover.

Translation: banks have kept the Fed’s new-minted money to bolster their liquidity reserves, and aren’t lending out the money to anyone.

But leaving this issue aside, what’s going on right now is a classic prisoner’s dilemma problem – devaluing your currency is an effective policy tool for reflating your economy by boosting external competitiveness. That’s certainly a necessity for the US, as the USD has been overvalued for generations. In the present case for emerging markets, devaluation can also be used to deter foreign capital inflows which are potentially destabilising and can cause asset price bubbles. But if everybody does it at once, then what we get is just status quo ante, with a dollop of financial instability thrown in for good measure.

But I don’t foresee any quick or easy resolution to this problem anytime soon, as the political and economic logic is clear for each individual country, even if each country’s efforts turn out to be futile in the end (as it must). As long as the US has to maintain monetary easing, there will be downward pressure on the USD, and pressure on other central banks to do likewise.

No winner but more sufferings for working class.

ReplyDeletesolomon