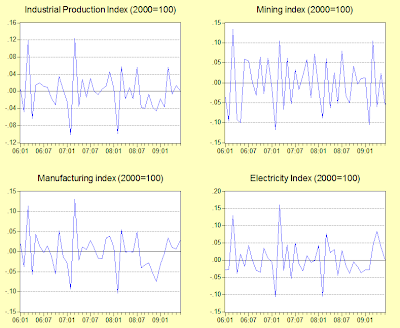

...and month on month changes aren't terribly encouraging either (log monthly changes; 2000=100):

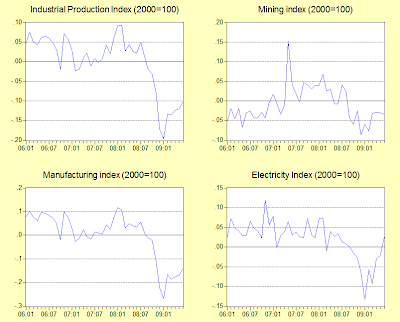

...but the indexes themselves have either flattened out or recovered (2000=100, seasonally adjusted):

The exception is Mining, but that can be attributed to higher prices and lower volume. It appears (barring a further downturn) that we actually hit bottom in December 2008, although it's hard to call what's happened since then a recovery given that the main index has been for all intents and purposes flat. What's interesting is that the electricity index is almost back to its long term trend channel:

That augurs well as far as the demand side is concerned: psychologically, people could be less concerned over the possibility of a deeper recession, so consumption is back up to nearly last year's levels - no need to watch the electricity bill so much. Alternatively on the supply side, factories have begun to spin up production again after a longer than normal winter shutdown - although I wouldn't argue that this will necessarily translate into higher production.

Or it may just be a lot warmer these days.

Whatever the reason, manufacturing has barely responded despite a recovery in electronics and electricals output, which suggests the demand side explanation is probably more correct.

As to when we'll see a broader more robust recovery, my guess is that will start kicking in when the funds from the stimulus packages begin being spent, rather than just disbursed. Production of some of the construction related manufactures are already up, but getting this spending into the broader economy might take a few more months.

No comments:

Post a Comment